boulder co sales tax rate 2020

Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle to a location in Colorado. Determining the increase in base revenue can be.

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

The Boulder County sales tax rate is 099.

. It also contains contact information for all self-collected jurisdictions. This rate includes any state county city and local sales taxes. What is the sales tax rate in Boulder County.

The December 2020 total local sales tax rate was also 4985. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. Method to calculate Boulder sales tax in 2021.

This rate includes any state county city and local sales taxes. If your business is located in a self-collected jurisdiction you must apply for a sales tax account with that city. Download and file the Retail Delivery Fee Return DR 1786 to register a Retail Delivery Fee account.

BOULDER COUNTY USE TAX For 2020 Boulder County collects use tax at the rate of 0985. The December 2020 total local sales tax rate was 8845. Use tax is levied in the following circumstances.

2020 rates included for use while preparing your income tax deduction. Wayfair Inc affect Colorado. Ad Find Out Sales Tax Rates For Free.

2055 lower than the maximum sales tax in CO. The latest sales tax rate for Boulder CO. This is the total of state county and city sales tax rates.

What is the sales tax rate in Boulder Colorado. The 2018 United States Supreme Court decision in South Dakota v. Storing using or consuming in Boulder County any motor or other vehicle purchased at retail on which a registraon is required.

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. The Boulder County Remainder Sales Tax is collected by the. This table shows the total sales tax rates for all cities and towns in.

The ESD tax is on top of the City of Boulder sales tax rate of 386. The current total local sales tax rate in Boulder CO is 4985. Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR.

Boulder County CO Sales Tax Rate. Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes. 2020 rates included for use while preparing your income tax deduction.

Effective July 1 2022. As permitted under CRS 39-10-1115 delinquent mobile home taxes may be struck off to the county rather than being offered for sale at auction. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

You can find more tax rates and allowances for Boulder and Colorado in the 2022 Colorado Tax Tables. Boulder Sales Tax Rates for 2022. Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595.

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. The County sales tax rate is. Boulder CO Sales Tax Rate.

Oil and Gas Leaseholds and Lands Primary Production 875 of oil or gas sold or transported from premises with modifications. If a vehicle is purchased from a private party all sales taxes are collected by Boulder County Motor Vehicle. Mobile Home Tax Lien Sale.

Para asistencia en español favor de mandarnos un email a. The 2020 Boulder County sales and use tax rate is 0985. The rate for certificates sold in 2022 will be set.

The esd tax is on top of the city of boulder sales tax rate of 386. Tax Lien Interest Rate. About City of Boulders Sales and Use Tax.

For tax rates in other cities see Colorado sales. You can print a 8845 sales tax table here. Our tax lien sale will be held November 18 2022.

The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists of a 099 county sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Our tax lien sale will be held December 2 2022. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The minimum combined 2022 sales tax rate for Boulder County Colorado is 499. The Colorado sales tax rate is currently. Higher sales tax than 89 of Colorado localities.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. 796 for residential proportion 29 for commercial. The Colorado state sales tax rate is currently 29.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. The minimum combined 2022 sales tax rate for Boulder Colorado is. Residential fluctuates from year-to-year 796.

July to December 2020. The latest sales tax rate for Boulder County CO. Did South Dakota v.

The average sales tax rate in Colorado is 6078. The current total local sales tax rate in Boulder County CO is 4985. The December 2020 total local sales tax rate was also 4985.

This document lists the sales and use tax rates for all Colorado cities counties and special districts. Commercial Industrial Personal Vacant Land or State Assessed Property. The Boulder sales tax rate is.

The Boulder Sales Tax is collected by the merchant on all qualifying sales. This is the total of state and county sales tax rates. The County sales tax rate is.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

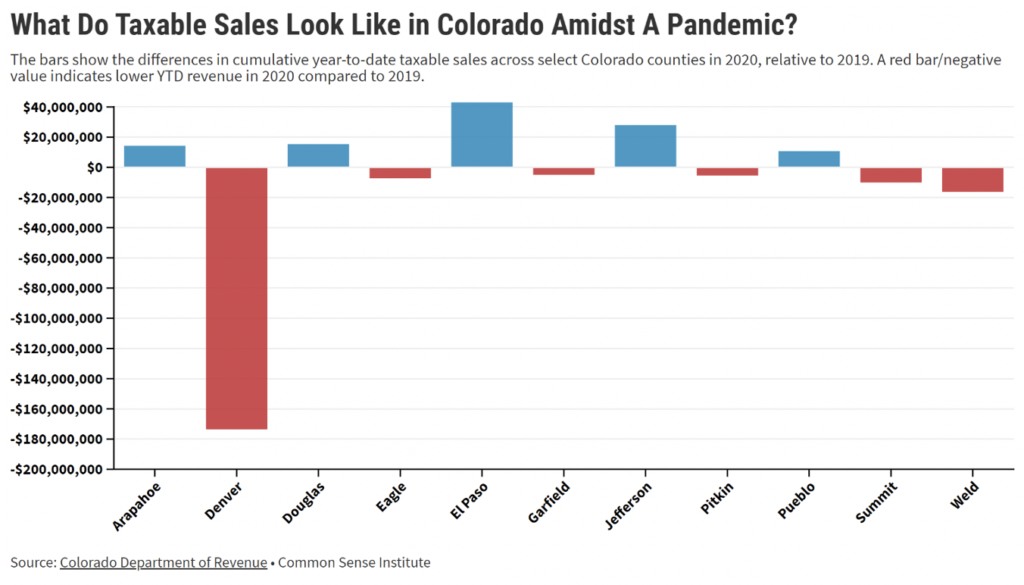

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado Sales Tax Rates By City County 2022

How Do Canadians Feel About Their High Tax Rates Quora

Nevada Sales Tax Guide For Businesses

Taxes In Boulder The State Of Colorado

Alberta Property Tax Rates Calculator Wowa Ca

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

California Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

2021 Property Appraisals And Tax Rates For Resorts At Walt Disney World

2021 Property Appraisals And Tax Rates For Resorts At Walt Disney World

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Sales And Use Tax City Of Boulder

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver