are combined federal campaign donations tax deductible

Contributions to qualified charitable organizations may be deductible. This was made possible only by a truly combined once-a-year campaign and greatly increased the size of contributions.

Are Political Contributions Tax Deductible Anedot

Only donations actually made before the close of the.

. For federal employees one organization that qualifies as a cashcheck charitable donation is the Combined Federal Campaign CFC. Contributions are not tax-deductible and are not subject to gift tax rules. Individuals can contribute up to 2800.

Open with Maximum Telework Flexibilities to all current telework eligible employees pursuant to direction from agency heads. Contributions to section 501 c 6 organizations are not deductible as charitable contributions on the donors federal. Businesses may donate to campaigns political parties and PACs but their contributions are not tax-deductible.

While tax deductible CFC deductions are not pre-tax. If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax. If you itemize your deductions you may be able to deduct charitable contributions of money or property made to qualified organizations.

Federal political contributions are donations that were made to a registered federal political party or a. There are also no deductions available for donations of in-kind services or for time that you volunteer. Typically deductible charitable contributions are those made to organizations that are tax-exempt under 501c3 of the Internal Revenue Code.

Despite continued skepticism about whether the consolidated. This type of organization is. Federal law does not allow for charitable.

Anonymous political donations could soon be tax deductible. On the part of the. A tax deduction allows a person to reduce their income as a result of certain expenses.

Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. There are five types of deductions for individuals work-related itemized education. In fact starting for the 2020 tax year you can take a charitable contribution deduction of up to 300.

Tax treatment of donations - 501 c 6 organizations. Employees typically make their donations. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign.

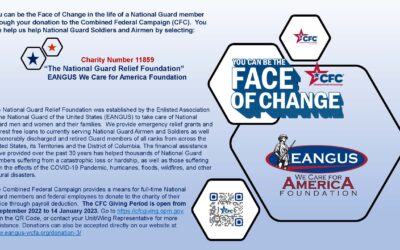

2022 Combined Federal Campaign Fundraiser Underway Show Some Love Be The Face Of Change National Association Of American Veterans

Combined Federal Campaign National Association Of Letter Carriers Afl Cio

Are Political Donations Tax Deductible Picnic Tax

Ways To Give Travis Mills Foundation

Why To Avoid 100 Of Agi Qualified Charitable Contributions

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

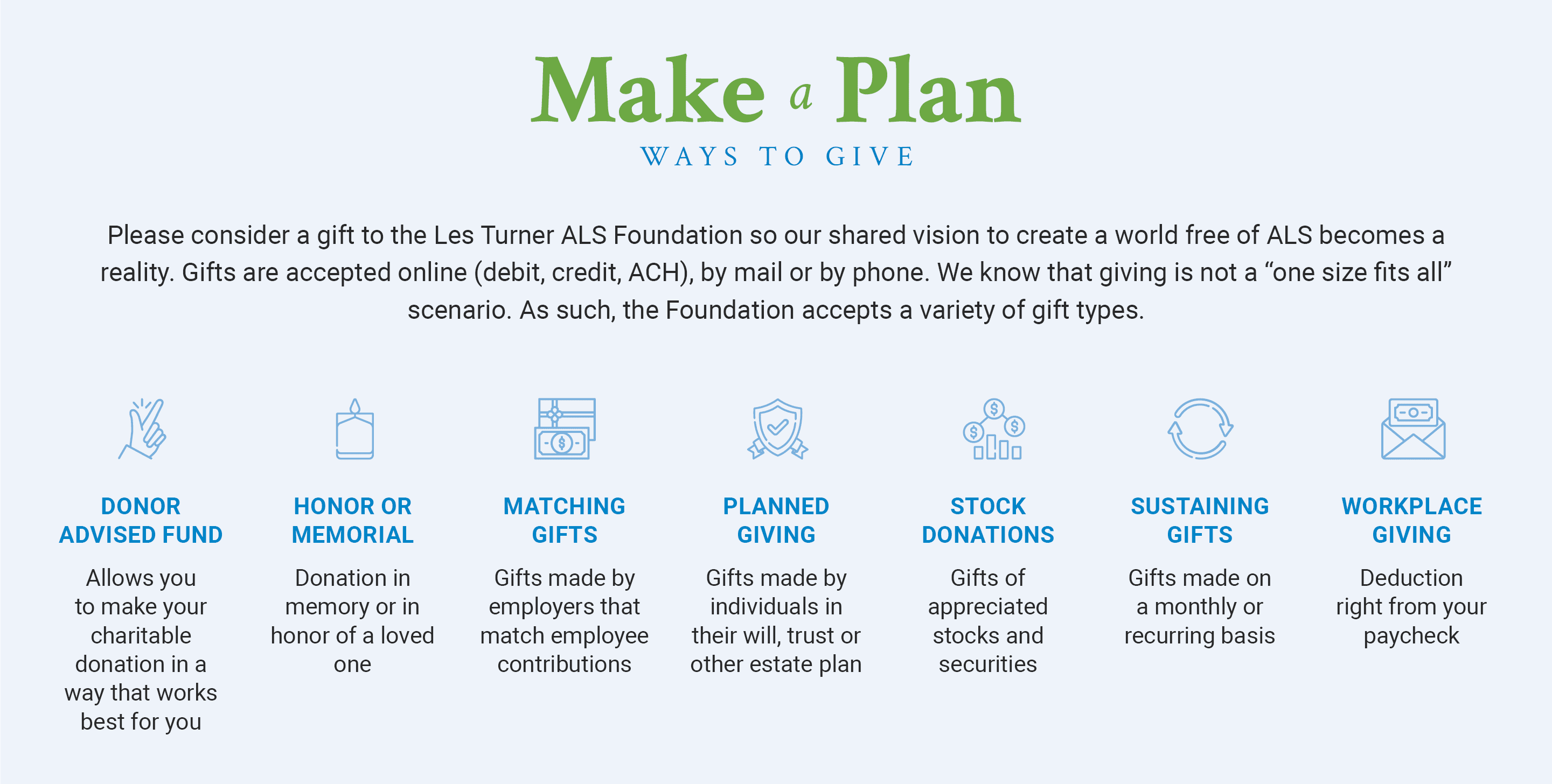

Donate To The Les Turner Als Foundation

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Are Political Contributions Tax Deductible H R Block

Combined Federal Campaign American Cancer Society

Home Virginia National Guard Enlisted Association

Midwestern Combined Federal Campaign Cfc Contributions Are Now Tax Deductible Make Your Gift Today At Cfcgiving Opm Gov Facebook

Combined Federal Campaign Wikipedia